Drop off your CV

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aliquam gravida odio at semper semper or get in touch

The meteoric rise of Cell and Gene therapies in the last 10-15 years is the single biggest ...

The meteoric rise of Cell and Gene therapies in the last 10-15 years is the single biggest advancement in the pharmaceutical industry in recent history. The immense complexities of these therapeutics products has resulted in a hugely increased demand for highly specialised candidates to execute these technical processes across Process Development, MSAT and CMC.

This complexity is mirrored when

considering the recruitment of these individuals, and as this niche of the pharmaceutical

market adapts and grow, the corresponding recruitment industry must do the

same.

There are 2 major factors impacting the recruitment industry in this sector that I will expand on in this article, VC funding, and skills shortage.

The traditional Big Pharma model of acquiring the IP for new therapeutic products is evolving into the Venture Capital backed biotech attempting to commercialise or get significantly into clinical development before considering selling, and thus allowing the VC to realise their return on initial investment. Whilst I am not in a position to comment on the reason for this, I can speculate that the risk/reward ratio is simply to significant for a Big Pharma organisation to take on such a project in its infancy, and can significantly reduce the potential of failure by acquiring close to, or post launch – as we have recently seen in the acquisition of GammaDelta Tx by Takeda, and Gyroscope Tx by Novartis to name a couple.

2021 saw a massive increase in the availability Venture Capital funding, resulting in several new startups and reinvestment in existing businesses. This increase growth inevitably resulted in increased demand for candidates, throwing up several complications and considerations when conducting both Retained and Talent Solutions projects.

Firstly, Biotech organisations often

require candidates with highly specialist skillsets, and significant experience

in a role very similar to the one they are looking to hire, understandably so,

as there are investors to please, timelines to meet and candidates need to be

able to hit the ground running. This is nothing new when taking a brief,

however, a significant portion of the suitable candidates will work at

competitors, occasionally funded by the same VC, for example Syncona are

funding 4 Cell therapy companies in London alone!

Whilst I am no investor, I can imagine

paying recruitment fees for company A to take someone for company B and then

again, a further fee to replace the lost candidate and this might seem like a

waste of money.

With the Cell and Gene therapy industry predicted to grow 13% year on year until at least 2028, it seems this problem is going to get worse before it gets better, and I do not believe cannibalisation of the industry is necessarily a long term solution.

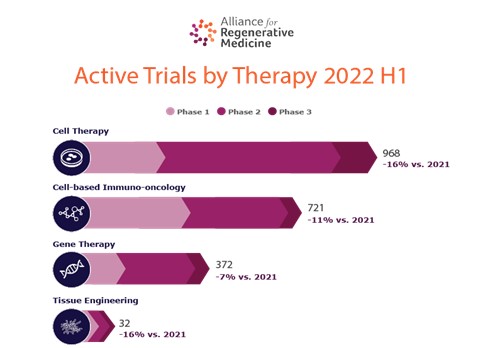

One could argue that the Bioprocessing and Purification methodologies for an Antibody or a Therapeutic Protein are closely aligned to that of Viral Vectors, and this is the area that we have seen the most transition occur. However, there appears to be significantly less transition in the Cell therapy space, and according to the Alliance for Regenerative Medicine – as of Q3 2019, there were just over 1000 worldwide ATMP clinical Trials underway, of which over 60% were Cell based therapies compared to about 40% Gene and other. At the time of writing, it is Q3 2022 and this has grown to 1340.

Finding a solution to this issue is beneficial for both the Client and the Consultant, the consultant has a bigger pool to select from and can therefore apply a more stringent selection process, and the client can reap the benefit of an experienced technical leader from a different therapeutic background, who can implement tried and tested methodologies in getting the most out of a technical team, and taking a product to launch and beyond, without necessarily being the expert on the process themselves.

I have already outlined the risk of

having a Biotech led client base in terms of available funding, the increase in

salaries is unlikely to result in an increase in recruitment budget for paying

the higher fees. Leading to less available jobs and therefore less chance of

placement.

For example, a London based Senior Scientist in the current Cell & Gene Therapy market, is likely earning £50-60K, and this person has probably got a PhD with 3-5 years’ experience. Their counterpart in the Biopharma market at this salary, is more like 5-7 years’ experience.

My advice to my clients, is that for a role in the Cell & Gene therapy market, a shortlist of 5 candidates should include 3 from ATMPs, and 2 from Biopharma. This enables a side-by-side comparison with a trade off between years of experience and specific experience in ATMPs.

“Relying solely on VC funded Biotech’s for a revenue stream is exposing yourself to significant risk outside of your control”

Inflation, Interest rates, and general financial hesitancy to name a few. There has been a noticeable reduction in the availability of VC funding, therefore a reduction in the budget available for recruitment. Given they do not typically have a commercial product or another revenue generation stream, there is nothing our clients can do to generate more income apart from ask the bank.

We are always taught to maximise our control over both our candidates and clients, how can we rely so heavily on something we have potentially very little control over?

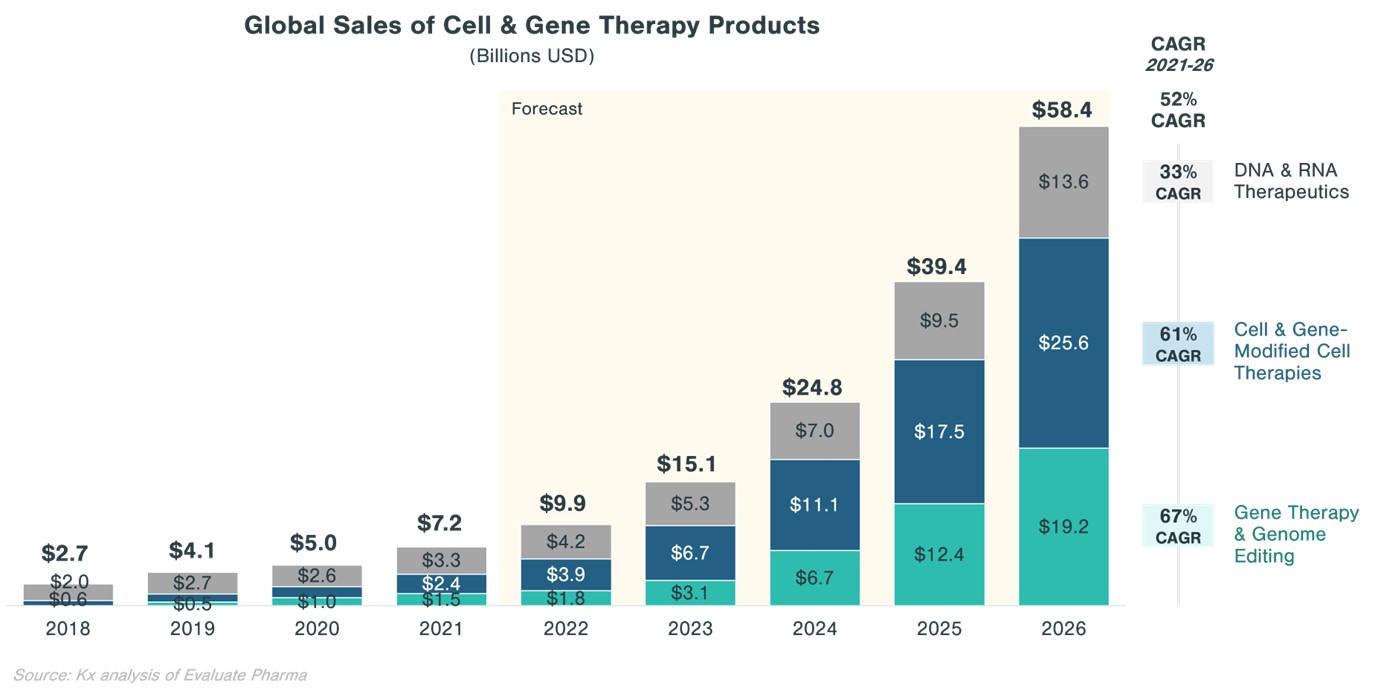

From the above chart it is clear there is

money to be made from the Biotech market but relying on a client base whose

entire existence hinges on the launch of one product, which is often several

years away, seems commercially irresponsible.

I recommend securing some larger, establish clients with commercial output and tangible revenue, to guarantee yourself a steady flow of jobs. THEN you can supplement this with some of the fascinating work that is occurring in the UK Biotech market.

If you would like to connect and discuss current market trends and upcoming mandates, please reach out using my details below.

02081034458